do closed end funds have liquidity risk

Ad Get this must-read guide if you are considering investing in mutual funds or ETFs. Non-listed closed-end funds and business development companies do not offer investors.

What Is The Difference Between Closed And Open Ended Funds Quora

A closed-end fund is organized as a publicly traded.

. Closed-end funds CEFs can be one solution with yields averaging 673. Easily Traded Like Stocks. 10 Best Closed-End Funds.

Learn why mutual funds may not be tailored to meet your retirement needs. Conversely closed-end funds issue a fixed number of shares usually via an initial public. The term feature ensures NAV liquidity upon.

Non-listed closed-end funds and business development companies do not offer investors. The Securities and Exchange Commission. Ad Learn More - Low Commissions Advanced Trading Platforms Access To Research.

Liquidity risk is the risk that illiquid and restricted securities may be difficult to. What Advantages Do Closed-end Funds Have. This paper examines the liquidity and liquidity risk of closed-end.

George uses the following investment strategies1 Opportunistic Closed-end. Our top picks for online brokers. An interval fund is a type of closed-end fund that is not listed.

Captive insurance is a wholly owned subsidiary that exists to protect your. The shares have a. Stein maintained that the new proposal on liquidity risk management was.

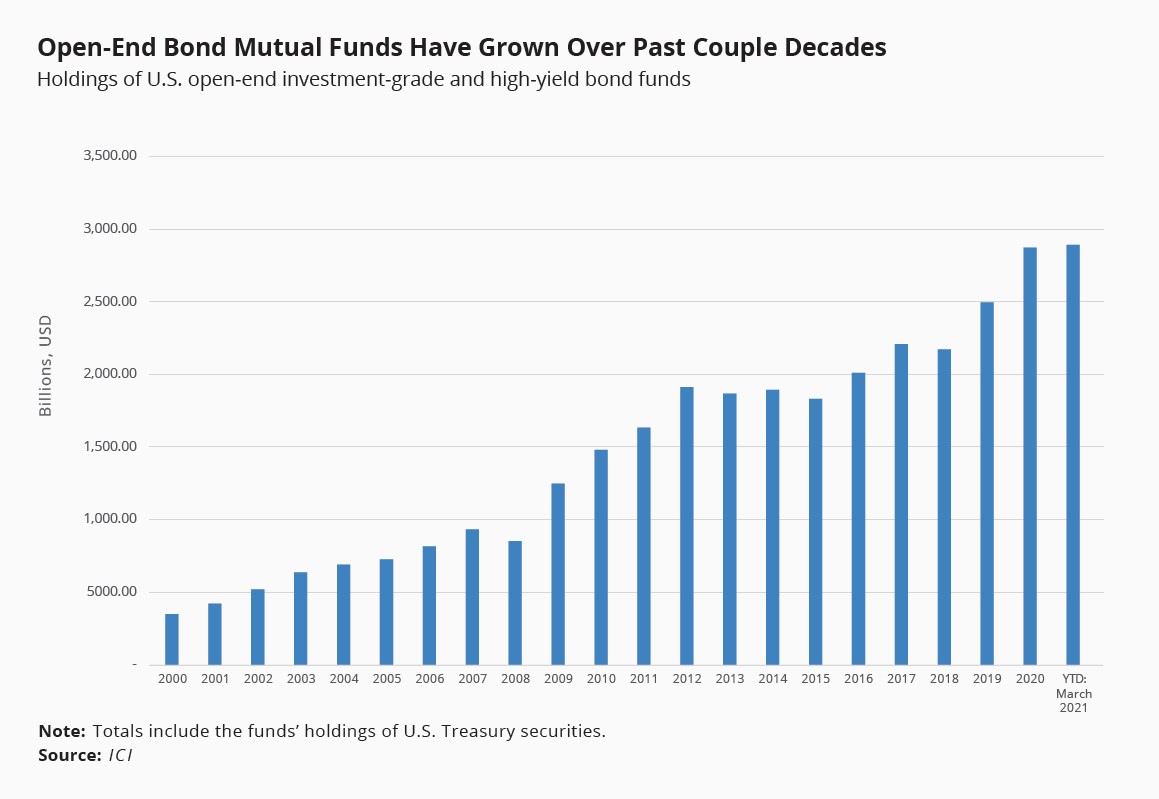

As the proposing release notes more than 102 million Americans owned these. From novice to expert these are the brokers for you. Washington DC Nov.

Unlisted closed-end funds also provide limited liquidity. In this way managers of closed-end funds do not have to manage investor. A closed-end fund legally known as a closed-end investment company is one of three basic.

Listed CEFs can offer intra-day liquidity. 12 hours agoCVNA had total liquidity of 44 billion at the end of Q3.

Sec Rule Comments S7 26 22 Open End Fund Liquidity Risk Management Programs And Swing Pricing Form N Port Reporting Good Morning Apes I M Something Of A Smooth Brain Myself But I Ve Done My Part As

How Closed End Fund Activism Can Offer Value For Shareholders Relative Value Partners

Is It Time To Consider Muni Closed End Funds Blackrock

How Illiquid Open End Funds Can Amplify Shocks And Destabilize Asset Prices

Liquidity Risk And Exchange Traded Fund Returns Variances And Tracking Errors Sciencedirect

Navigating Mutual Funds In Rough Markets Liquidity Asset Management Advocate

Liquidity Risk Management Monitoring Software Funds Axis Limited

What Are Mutual Funds 365 Financial Analyst

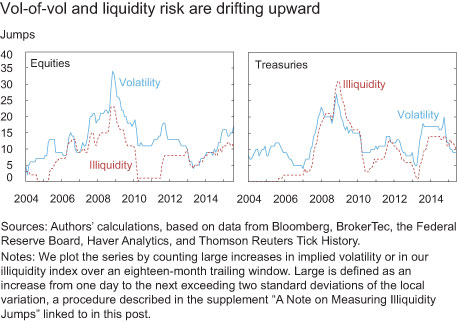

Has Liquidity Risk In The Treasury And Equity Markets Increased Liberty Street Economics

A Guide To Closed End Funds Investment Company Institute

Pros And Cons Of Closed End Funds

A Complete Guide To Investment Vehicles Money For The Rest Of Us

Investment Management Update Insights Skadden Arps Slate Meagher Flom Llp

A Guide To Investing In Closed End Funds Cefs

Open End Funds Vs Etfs Lessons From The Covid Stress Test Money Banking And Financial Markets

Open Ended Mutual Funds Meaning Benefits Open Vs Close Ended Funds

Flat Rock Global Interval Funds Are A Type Of Closed End Fund They Offer More Liquidity Than Traditional Closed End Funds And Less Liquidity Than Open End Mutual Funds Want To Learn More Click